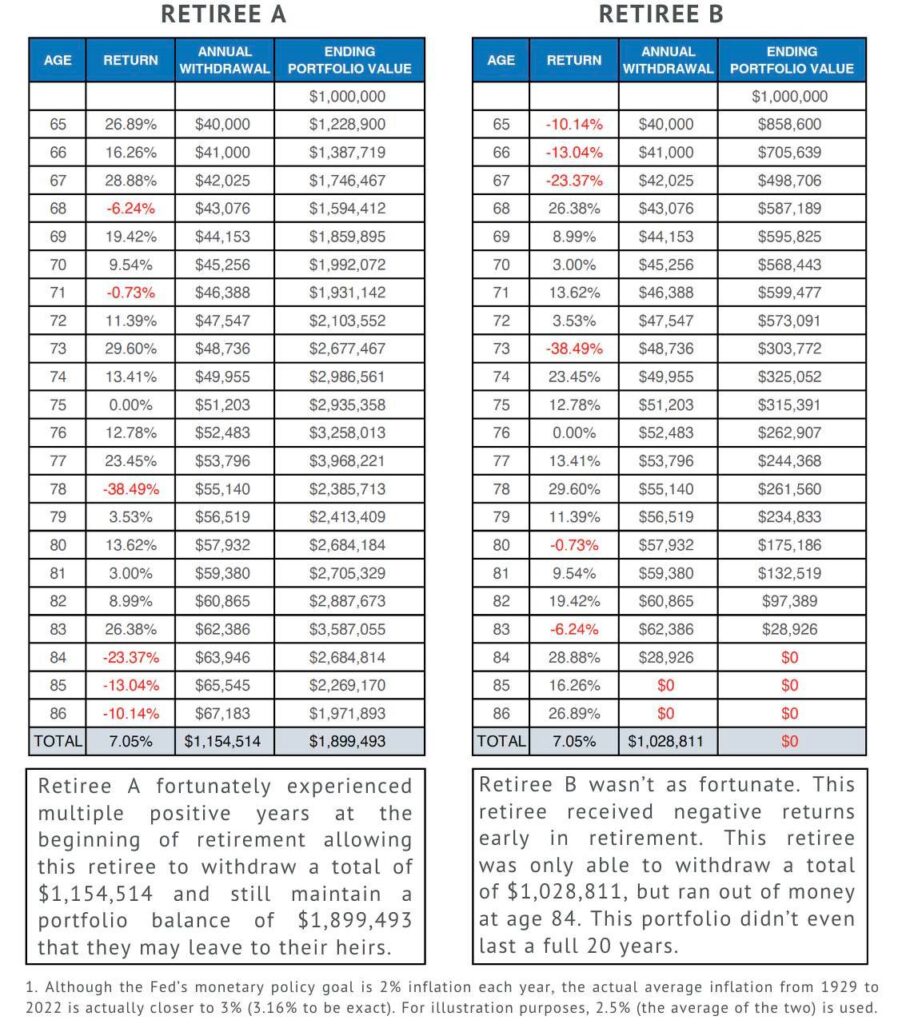

“The 4% Rule,” invented by a financial advisor in the mid-90s, states that if a retiree has a retirement portfolio of 50% stocks and 50% bonds then they should be able to withdraw 4% of their portfolio each year plus an adjusted amount to account for inflation without exhausting their portfolio in retirement.

Although “The 4% Rule” (or theory) may provide a predictable and easy to follow withdrawal process, it ignores many financial implications that can affect a retirement portfolio, such as rising taxes, inflation, a spouse needing long term care, or a retiree beginning retirement with a negative sequence of returns.

You may have heard the phrase “timing is everything,” and in regards to when you begin retirement that phrase certainly holds true. Experiencing a bad sequence of returns (multiple negative return years early in your retirement) is one of the biggest risks that can cause you to out-live your retirement portfolio. Withdrawing funds from your retirement when experiencing a bad sequence of returns only compounds the problem.

In order to better understand how having a bad sequence of returns in the early years of your retirement can negatively affect your portfolio, the following two scenarios will illustrate experiencing both a good sequence of returns as well as a bad one.

Both scenarios will depict the exact same returns, but one of them will be in reverse order.

𝙏𝙝𝙚 𝙧𝙚𝙨𝙪𝙡𝙩𝙨 𝙤𝙛 𝙚𝙖𝙘𝙝 𝙍𝙚𝙩𝙞𝙧𝙚𝙚’𝙨 𝙨𝙚𝙦𝙪𝙚𝙣𝙘𝙚 𝙤𝙛 𝙧𝙚𝙩𝙪𝙧𝙣𝙨 𝙖𝙧𝙚 𝙙𝙚𝙥𝙞𝙘𝙩𝙚𝙙 𝙗𝙚𝙡𝙤𝙬 𝙚𝙖𝙘𝙝 𝙘𝙝𝙖𝙧𝙩. 𝙏𝙝𝙚 𝙧𝙚𝙨𝙪𝙡𝙩𝙨 𝙖𝙧𝙚 𝙖𝙨𝙩𝙤𝙪𝙣𝙙𝙞𝙣𝙜.

Note that in both scenarios an increase in taxes, the need for long term care, and many other retirement risks were not taken into consideration. All that was taken into account was a 4% withdrawal plus a 2.5% annual increase to adjust for inflation.

Don’t let the lack of planning and preparing for a bad sequence of returns rob you off a happy retirement. The time to prepare is now. I’m helping my clients protect their accounts from this risk and many others every day. If you’re interested in how I do it, let’s setup a time to talk about some options.