It’s no secret that there’s a lot of fear and uncertainty in the stock market these days. Unfortunately, most Americans’ retirement savings are exposed to the market’s volatility in addition to being charged management fees, but thankfully more and more Americans are seeing the writing on the wall and are returning to traditional retirement plans.

What are traditional retirement plans? Well, until the creation of 401(k)s in the 1980s, Americans used insurance to secure their retirement savings. So why didn’t you know this? It’s because the same financial institutions who promote 401(k)s and IRAs have mainstream media and the government promoting the plans that will make Wall Street wealthy and allow the government to take more of your retirement money in the form of taxes at a time when you need the money the most.

They also put out messaging that insurance companies aren’t the safest place to put your money. That’s right… the very financial institutions that are riddled with scandal after scandal and have lost many Americans half of their retirement (or more) from 2000-2002 and almost another 40% in 2008 and didn’t get them back to break even until 2013 is telling you that other options aren’t safe.

HERE’S THE TRUTH:

Letting insurance companies manage your money is not only safer, but it can be more profitable as well as you’ll see below!

1. Mutual insurance companies are extremely safe. Your money is secure when you put it into a life insurance company. The business model for insurance is actuarial science – the profit for an insurance company is based on extremely accurate mathematical models. Actuarial science tells a life insurance company exactly how much money it will need to pay out each year in insurance claims. The profit for insurance companies is designed not by a probability, but by an inevitability. Some highly predictable number of the people covered by their insurance will die each year. Everything the company does is based on that knowledge.

2. Insurance companies are highly regulated at the state and federal level. Among many other strict requirements, they must have enough regulated, liquid assets in reserve to pay 100 percent of the present value of claims. Rating agencies such as A.M. Best, S&P, and Moody constantly analyze and rank insurance company stability and are quick to spot problems with a company’s asset.

3. Each state has a guaranty association that acts as a safety net for policyholders in case an insurer becomes insolvent. It’s as if every single state has its own FDIC. The amounts each state will cover are regulated by the state insurance department. Regulators can almost always spot a company in trouble well in advance of insolvency and force it to take steps, including selling itself to another insurer, to correct any problems.

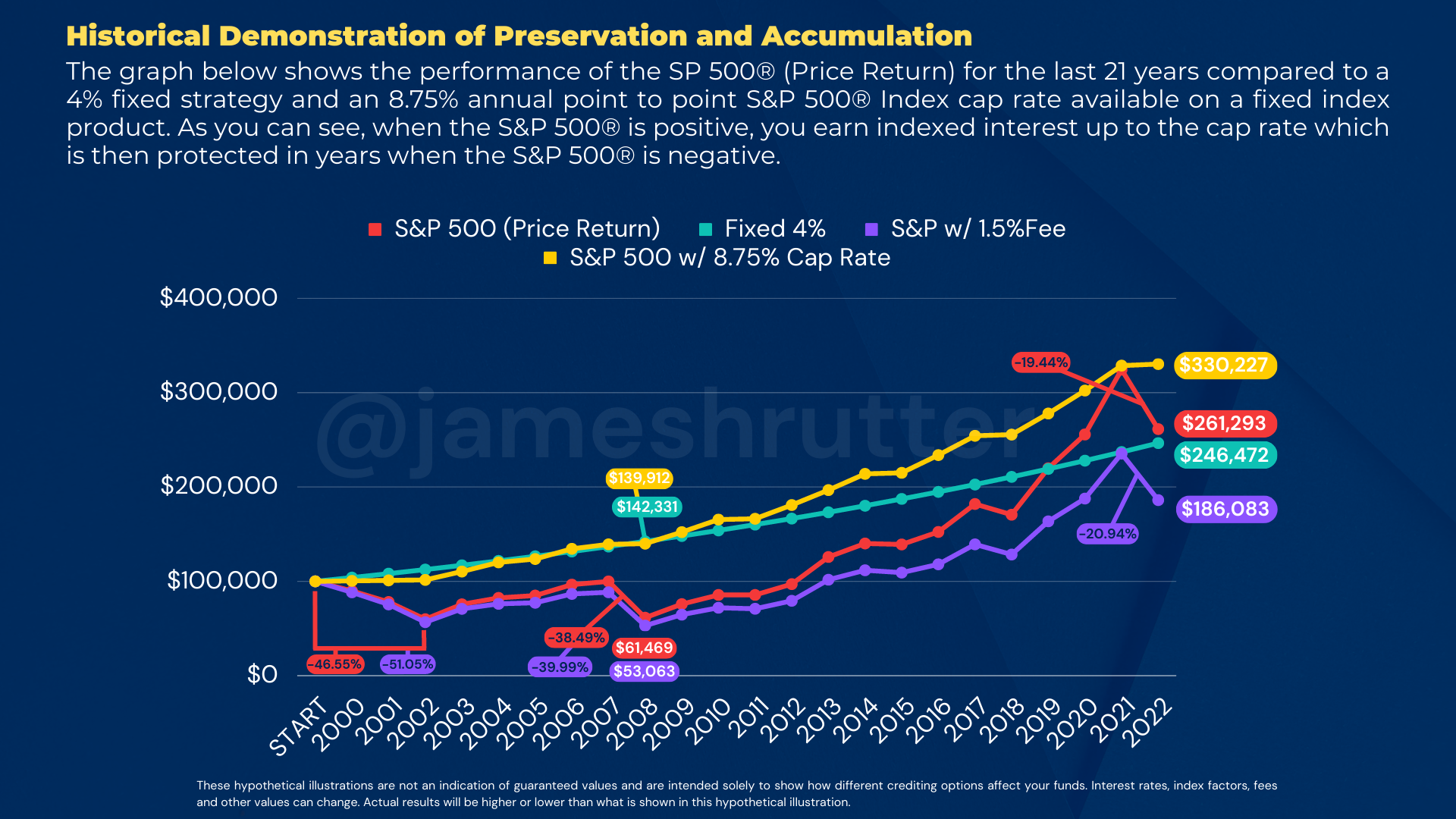

4. The growth on your funds can be the same or even greater with an insurance product. Wall Street will tell you otherwise, but here’s a simple chart showing real life numbers of how one of my most popular type of retirement insurance products has out-performed the market with actual real life numbers. I’m a big fan of letting the numbers do the talking and this chart shows all that needs to be said on performance.

For those reasons, and many others, I partner with mutual insurance companies to help secure and grow my clients’ retirement accounts.