If you had a choice between your car always moving toward your destination without having to pay for any gas or you could pay for gas that would sometimes make your car drive faster, but would also make it drive backwards sometimes, which would you choose?

This is the reality with many retirement accounts. Let me explain.

When your retirement portfolio is losing money during a market downturn, YOU’RE STILL PAYING FEES (gas). That means that you still pay for gas even though that gas makes you go backwards.

Then get this… you pay fees again (more gas) just to make the money back that your portfolio previously lost. So you’re paying fees TWICE on the same money!

Imagine paying for gas and driving your vehicle only to burn all that gas and not move an inch toward your destination! That’s what’s happening here. After you paid for gas that made you go backwards, you then have to pay for more gas just to get you back to where you were before driving backwards.

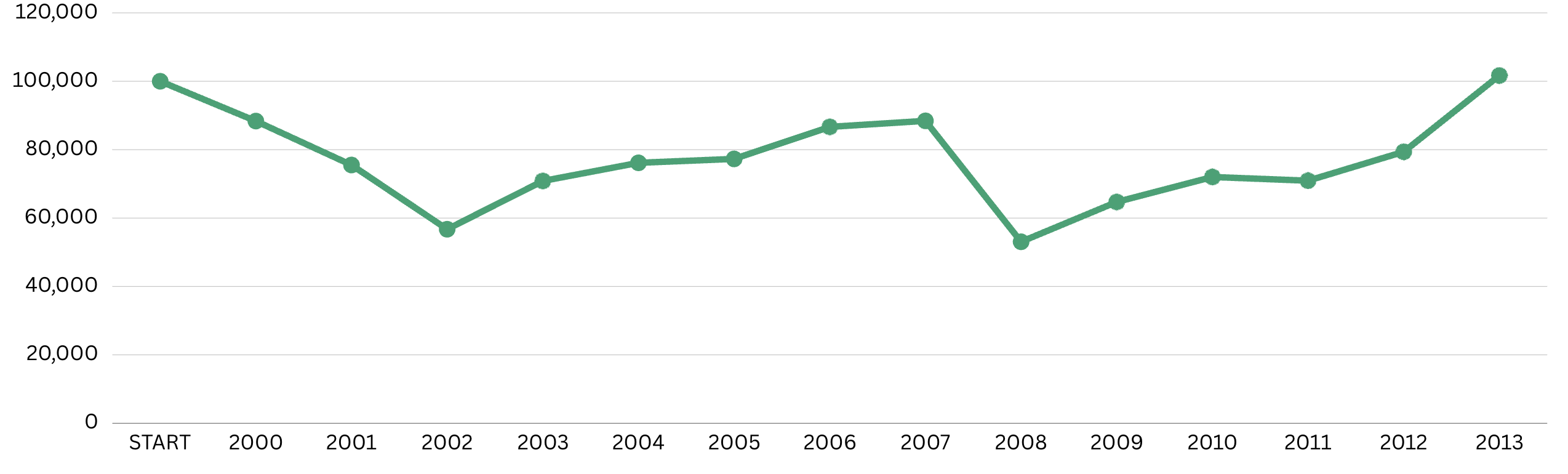

Most people who were in the market in 2000 experienced this. After the 2000 drop, it took until 2013 for the S&P 500 to get back to break even. That’s 13 years of paying fees (in both up years and down years) only to get back to where you started. Your advisor doesn’t mind though because they made money over that time period even though you didn’t. The sad reality is that you would’ve been better off putting your money in a traditional savings account earning 0.06% interest during that time-frame.

The reason why fees are so damaging is because every time that money is deducted from your account, it is no longer invested for you to grow your portfolio. It goes right into your financial advisor’s pocket. It’s also not invested for you the following year and neither are that year’s fees, or the next, or the next, and so on. It compounds negatively against you.

Here’s a simple illustration for you. If you put $100,000 into the S&P 500 in the year 2000 and didn’t add to it or take any withdrawals to 2021 then you would’ve been profitable. That would be a good thing, right? Of course it is. The bad part is with just a 1.5% fee it would’ve cost you $89,000 in fees over those years!!! That means that $89k wasn’t invested for you in year 2022 and so on. So you can’t achieve gains on that money and it becomes a compounding loss in retirement income. This is how a little 1% fee can rob you of 10 years of retirement income.

It’s true that if you pay for your own gas, that gas may make your car driving faster sometimes, but is it worth it if you don’t know when it can make you drive backwards? How much does driving faster on occasions help you if you’re driving just as fast in the wrong direction at other times?

Here’s a chart showing what $100k in the S&P 500 would’ve done from 2000-2013.

Here’s the truth that most people don’t know. You can achieve growth (even double-digit growth in some years) without paying for gas at all and without having to worry about driving backwards. You can keep driving forward knowing that you don’t need to pay for gas.

This is what I help my clients achieve – growth without the stress of driving backwards and without having to pay for any gas money!

To learn the tools I use to protect my clients’ retirement accounts from market loss and fees, let’s setup a time to chat.