AN ALTERNATIVE WAY TO SAVE FOR COLLEGE:

Many years ago when my wife and I were looking to setup some college funding accounts for our children, we went to our CFP and were given a couple options.

One of those options was some sort of a 529 plan and the other was a custodial account where our child would get full control of the money at 18 and there was nothing we could do about it. YIKES!

Let’s look at the two options the financial advisor gave me:

THE CUSTODIAL ACCOUNT: We weren’t too keen on turning over tens of thousands of dollars over to an 18 year old (or 21 year old depending on the state) even though we feel pretty confident we will raise them properly to where they’d be responsible with the money.

THE 529 ACCOUNT: We had several reservations with these…

The biggest concern we had was what if our kids didn’t want to go to college and to be honest, we don’t think we even want our kids going to college right now because they seem more like indoctrination camps. So if we stuffed a bunch of money into those plans and they didn’t go to college then we’d 𝗽𝗮𝘆 𝗮 𝗽𝗲𝗻𝗮𝗹𝘁𝘆 to withdraw the money.

What if they did go to college, but received a full scholarship. Then they couldn’t use the money for a “qualified educational expense.”

Most of the 529 plans charge 𝗳𝗲𝗲𝘀, which eat away at growth.

Speaking of growth, you may not even have growth and instead 𝗰𝗼𝘂𝗹𝗱 𝗶𝗻𝗰𝘂𝗿 𝗹𝗼𝘀𝘀𝗲𝘀 where your money would’ve been better put into a savings account. At the time of this writing 529 plans are taking a huge hit.

If we didn’t use the money for a “qualified educational expense” then we would not only lose the tax benefits on the earnings, but would also incur opportunity loss on that money because we could’ve used that money for other investment purposes during the contribution years.

THE OTHER COLLEGE SAVINGS OPTION:

WHAT IF…

What if you instead of opening up a 529 plan for your children you insured them with an infinite banking policy? Here would be the benefits of doing so:

- You are in complete control of the money (always unless you want to turn the policy ownership over to your children).

- You can turn over ownership to them at some point if you want to and they could use the money for college, to start a business, for their first car, for their wedding, honeymoon, etc.

- You would completely avoid the risk of loss (529s and custodial accounts are dependent on the stock market to grow and can lose money).

- You would avoid the 529 and custodial account fees.

- You would have guaranteed growth.

- You could use the cash value for whatever you want.

- You won’t get penalized for using the money.

For those reasons it became a no-brainer for us. We opened up banking policies for our children and when we feel they are mature enough we plan on turning the policies over to them to utilize the cash value however they please.

They can either quit paying into the policy, which is called “reduce paid- up,” or they can continue to contribute to it if they want to continue to grow the policy. It’ll be completely up to them.

We can use the policy to leverage its cash value while we remain the owner of the policy and then turn it over to them later.

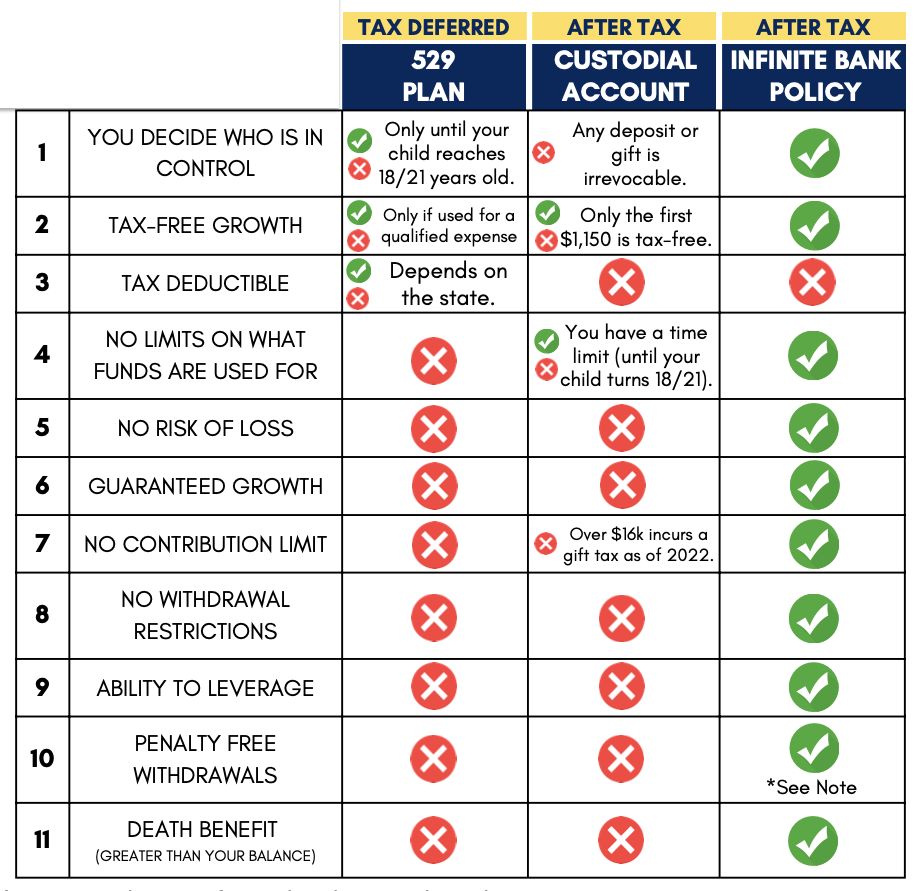

Let’s look at a simple side-by-side of 529s, custodial accounts, and a banking policy for your child.

*Note: With an infinite banking policy there are two ways to access your funds. One way is through loans, which we discussed earlier. The other is through withdrawals. Taking withdrawals past your cost basis could cause taxes consequences plus withdrawing removes the ability for your money to grow and you can’ put that money back into the policy.

Using loans, on the other hand, ensures the growth of your policy because you keep getting paid interest and dividends on your money while you use the insurance company’s money. I always suggest taking loans until you’re ready to drain the policy in retirement years.